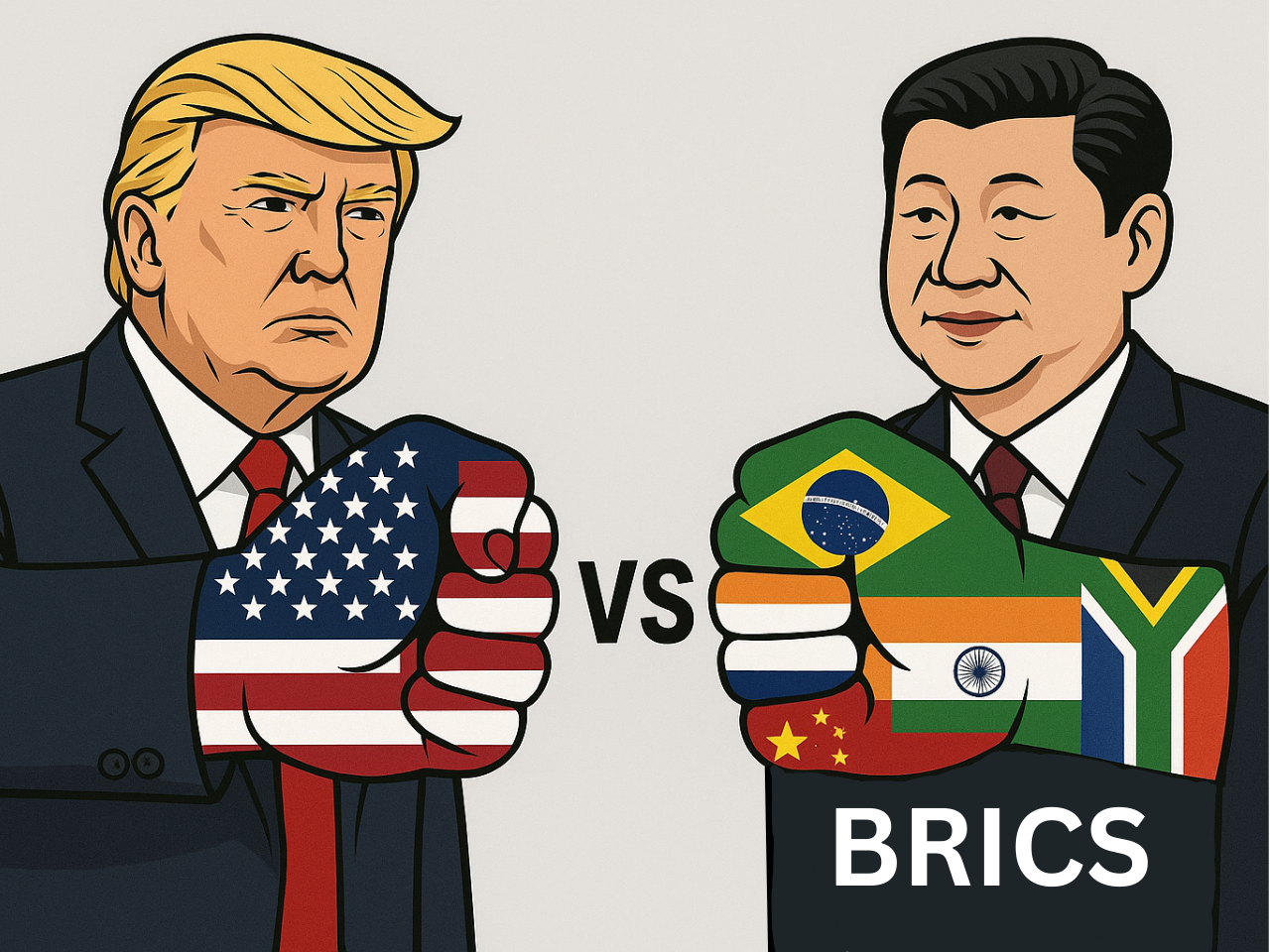

How BRICS shakes the USA empire: what BRICS currency can do?

BRICS formed in 2001 with their own members Brazil, Russia, India, China, and South Africa. These nations are making that very influential union in the world, and that union of nations is a very strong and different category; it makes a difference with other unions in the world. Currently now, the BRICS union has become the most influential union in the world and has the other unions sending back, G7, NATO, etc. Because of the six new members joining together with BRICS, they are Saudi Arabia, Egypt, the United Arab Emirates, Ethiopia, Indonesia, and Iran. Now there are a total of 11 members in the BRICS union, and they are personally establishing their own bank, the Bank of a Multilateral Development Bank, for personal finance assistance with their member nations, and they are bringing their own currency, the currency named UNIT. This UNIT currency is an alternative to the US dollar. This is the major point of why America fears the BRICS union. Because UNIT currency is sent back to the US dollar, it makes not only the US dollar but also the economy sent back, because the US economy depends on their currency value, it had the possibility to collapse the US economy.

Medium of Exchange—

The first medium of exchange used in international trade is gold. It was accepted by all nations so that period all the nations used the medium of exchange, gold, for international trade, and it makes an issue because gold is a limited resource, so the price or value of the gold fluctuates more; it's unstable, and it brings problems in international trade. So we need an alternative to gold. In that period, the US dollar was the strongest currency, as it was accepted as a medium of exchange. The demand for the US dollar currency started to rise, and as demand for currency rises, the increases in the value or exchange rate of the currency also rise. America influences the global nations with their currency. The demand for their currency is high, so the value of the currency is also high, so they easily import the goods and services between other nations. The value of the currency is high, so it makes it low cost to import as an alternative to producing that product. America enjoyed the benefit of the fixed US dollar as a medium of exchange. They start importing and reduce their production because it's a low-cost alternative to producing. Here the BRICS union brings the alternative to the US dollar for the medium of exchange. The BRICS member nations without the US dollar do the trade between the BRICS unit currency. How does it make the problem for America? If BRICS nations start doing international trade without the use of the US dollar, demand for the American currency of dollars will decline, which means the value, or said exchange rate, of the currency will also decline. The American economy depends on its currency; if the currency slides, the economy also declines.

America what does now?—

America forces the BRICS nations to withdraw the BRICS currency proposal. The way to force the withdrawal of the proposal with the BRICS member nations. Increase the tariff with BRICS member nations and how it will affect the nations. Before they fixed the US dollar as a medium of exchange, Americans reduced production and started importing more, so now they are imposing the tariff, which means increasing the tax on imported goods in BRICS member nations. These nations are not able to sell their product in America because the price of the product is rising because of the imposed high tax on that product. All this happens only to withdraw the proposal of a BRICS currency. Because BRICS currency comes, the nation of America's economy is directly affected.

Possibility of bringing BRICS currency—

Europe currency was one of the periods it said no way, but now it works well. The euro currency is also union currency, not one nation's currency; it's European Union currency for 27 member nations common currency, but now 43 countries and territories have the euro as the official currency. It's happened, so a BRICS currency is also a possibility. Already Euro nations can't use the US dollar for trade between the Eurozone; it's already one back from America. Maybe the BRICS currency comes, and Asian nations also use the BRICS currency for trade between the Asian zone. It's a huge setback to America and its economy. As a result, America loses the availability of medium exchange in the eurozone and Asian zones! It's making America backward; the overall demand for the US dollar is vertically declining. America was not able to import goods from other nations as easily as before because demand for the US dollar currency was falling, so the value or exchange rate of the dollar was low. So the American production of goods is comparatively low cost compared to importing goods from other nations, and it's happening because demand for the US dollar is declining. After this all happens, America will not produce and secure their natural resources for the future and will start again to import the goods and services from other nations, which will make the American economy decline more, and the currency value or exchange rate will also decline at this time because imports are greater than exports, which is why the US dollar is declining more comparatively before it declines.