The Timeless Value of Gold: Why This Ancient Metal Remains a Safe Haven in Uncertain Times

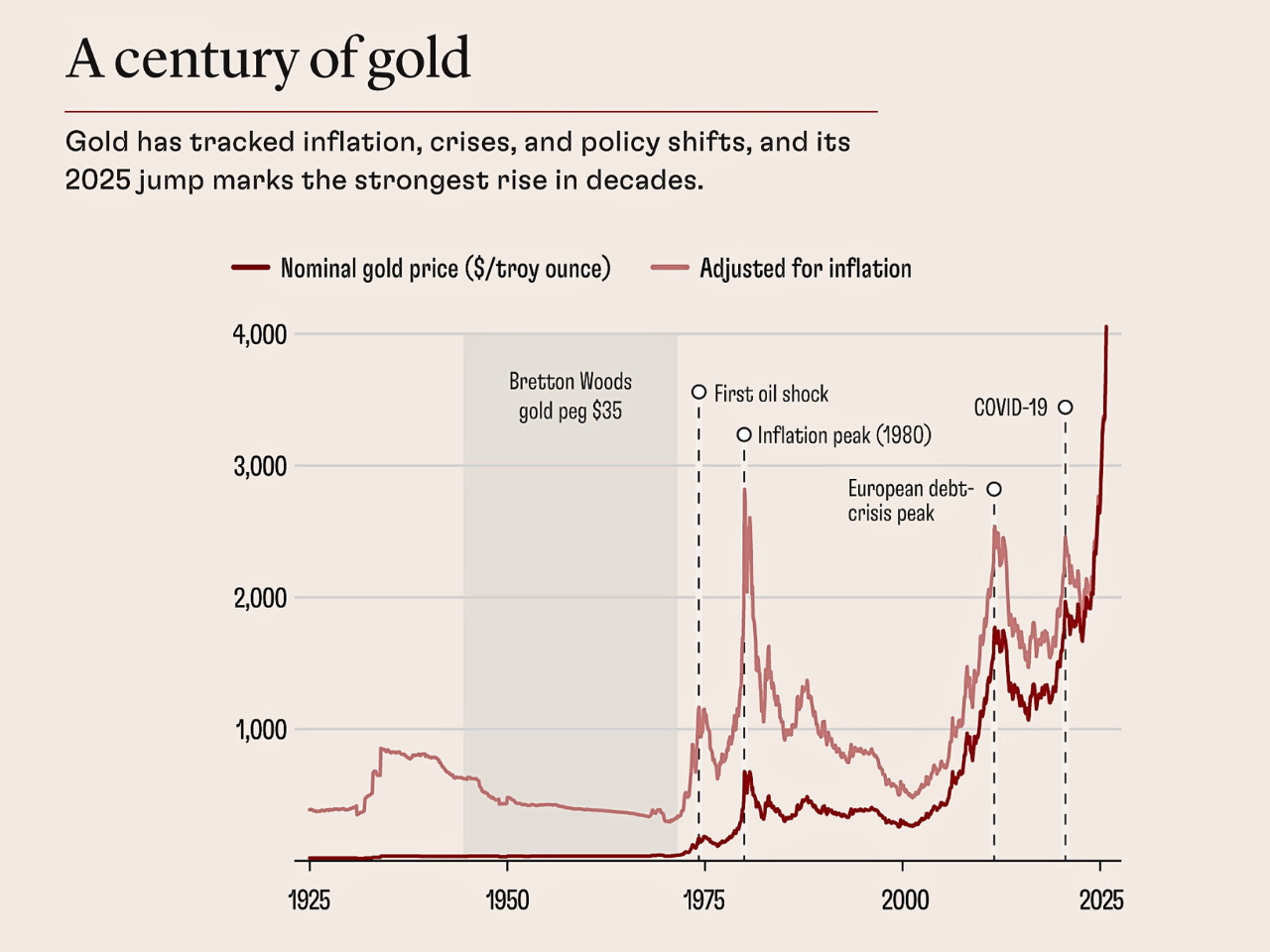

The reason why the oldest store of value in the world is still relevant Gold has held a special place in human society for more than 5,000 years. Empires came and went, currencies came and went, and financial systems have been recreated many times, but gold has lasted. The relevance of the metal in the times of cryptocurrencies, artificial intelligence, and central bank digital currencies might seem confusing. But recent events, such as the phenomenal increase in prices in 2025, prove that the attractiveness of gold is not a phenomenon of the past, but a factor that is being conditioned by timeless economic and psychological laws. This outstanding journey is captured in the chart known as A Century of Gold. The past century has shown the close relation of gold prices to inflation, financial crises, and significant changes in policy. The most notable is the steep increase in 2025, as the highest annual growth in decades, in support of the persistence of gold as a haven of uncertainty.

Sacred Metal into Monetary Anchor-

The first value of gold had nothing to do with markets, but with significance. Gold was linked to God, immortality, and authority as practiced by the ancient cultures of Egypt, Mesopotamia, and Roman cultures. The combination of its physical properties, resistance to corrosion, malleability, and scarcity made it the most suitable material to use in ornamentation and, later, money. The gold coins introduced by the Lydians in the seventh century BCE led to a new era where standardized trade was possible, and the beginnings of monetary systems were established.

By the 19th century, gold had become the foundation of the international financial order. With the classical gold standard, the money could be directly converted into a fixed amount of gold, and this form of discipline kept governments in check, as well as fixed exchange rates. International trade and capital flows promoted by this system have a price: inflexibility. In times of economic stagnation, in particular, the Great Depression, the gold convertibility impeded policy actions and further deflation.

The Bretton Woods and the Death of Convertibility-

The policymakers wanted to settle on a halfway course after World War II. The Bretton Woods system pegged the US dollar against gold at $35 per ounce, and the other currencies were pegged against the dollar. This structure was highly reliant on the US economic prowess. Gold prices at this time, as indicated in the chart, were constant as a sign of the fixed peg.

This stability fell apart in the late 60s. The US deficit, which was increasing because of spending on war and domestic spending, damaged the trust in the convertibility of the dollar. In 1971, President Richard Nixon suspended the convertibility of gold, which in effect abolished the world gold standard. Metal-backed money was substituted by fiat currencies, and gold was liberated to trade at market prices. Rather than eroding the relevance of gold, this change signified the end of gold as a monetary anchor and the beginning of gold as a financial indicator.

Since the 1970s, gold has been used as more of an investment refuge. Its price history is marked by every significant shock in the world. In the 1970s, as the oil crisis and high inflation occurred, the gold prices shot up, reaching a high in 1980 when the inflation destroyed confidence in the use of monetary policy. The inflation-adjusted line in the chart shows the exceptional nature of that episode. This trend was continued in subsequent crises. Late in the 2008 financial crisis around the world, gold reached over $1,000 per ounce as people no longer trusted banks and credit markets.

During the COVID-19 crisis in 2020, with unprecedented stimulus and economic fear, the gold price went to levels not seen since 2008, at $2,000. The most recent explosion, however different. The 2025 increase in the price of gold was about 40 per cent, to an all-time high of over 4000 an ounce, the best annual increase in gold since the inflationary days of the late 1970s.

Return of Gold and Central Banks-

Central bank demand has been one of the major causes of this recent rally. China, India, Turkey, and Poland alone have already bought over 1,100 metric tons of gold in one year, which is a remarkable amount of gold, according to historical aspects. This is beyond portfolio diversification. Gold is neutral in the universe, where sanctions and financial networks can be turned into weapons. It does not have counterparty risk and is not under the jurisdiction of any particular country.

The geopolitical hedging with Gold is gaining importance. With the global power becoming more oriented toward a multipolar form, nations are looking to find assets that safeguard sovereignty. Gold, which had been rejected as obsolete, is re-emerging as a strategic reserve, not in the form of money, but insurance.

The timeless worth of gold is based on three basic attributes, namely scarcity, durability, and trust. The increase in the global supply due to annual gold mining is about 1.5 percent, which is much slower than the world is growing in terms of fiat money or digital assets. Approximately 210,000 metric tons of gold mined over the years remain to this day. This almost permanent quality of gold makes it unlike most commodities.

But scarcity is no longer a sufficient reason why gold is valuable. Its strength is in shared ideology. Gold earns no interest, no dividends, and has few industrial applications as compared to its market value. It becomes increasingly attractive when trust in monetary systems is undermined, especially when real interest rates become negative. Gold does not prosper, but it prospers on uncertainty.

Gold is a psychological stabilizer for investors. It is usually suggested that a small percentage, 5-10 percent, of a portfolio should not get high returns, but rather stand strong. The fact that gold moves on the opposite side of equities when economic times are bad is a compensating factor when markets go wrong.

The role of gold is even more cultural. In India, the amount of gold in the hands of households is more than all the central banks of the world combined. As a decorative item, savings and security, Gold is deeply rooted in societal rituals. Gold in China signifies good fortune, righteousness, and posterity. At times of economic pressure, the physical demand for gold tends to be high, and the emotional and economic boundaries tend to be lost.

Gold vs. Crypto: Faith, new faith-

The emergence of cryptocurrencies has brought back the discussion of the essence of value. Bitcoin has been referred to as digital gold, which also possesses similar characteristics, such as scarcity and lack of centrality. However, they share one thing, and that is places of money in society. The analogy emphasizes the fact that value does not lie in form, but in conviction.

An Eternal Hedge in a Transitional World-

The Exchange-Traded Fund (ETFs) on gold and tokenized gold technology have brought technological advancements that have shifted the access and trade of the metal. Such inventions, however, have not changed the nature of gold. Through all the upheavals of inflation, crisis, and policy changes, gold, as the chart reveals, has been a reflection of uncertainty. Gold is reassuring in a digital world filled with abstractions. It will come and go in regard to its price, but its meaning will remain.

Free To Activate Membership