World Bank Warns of Stunted Global Growth: 2.3% Forecast for 2025

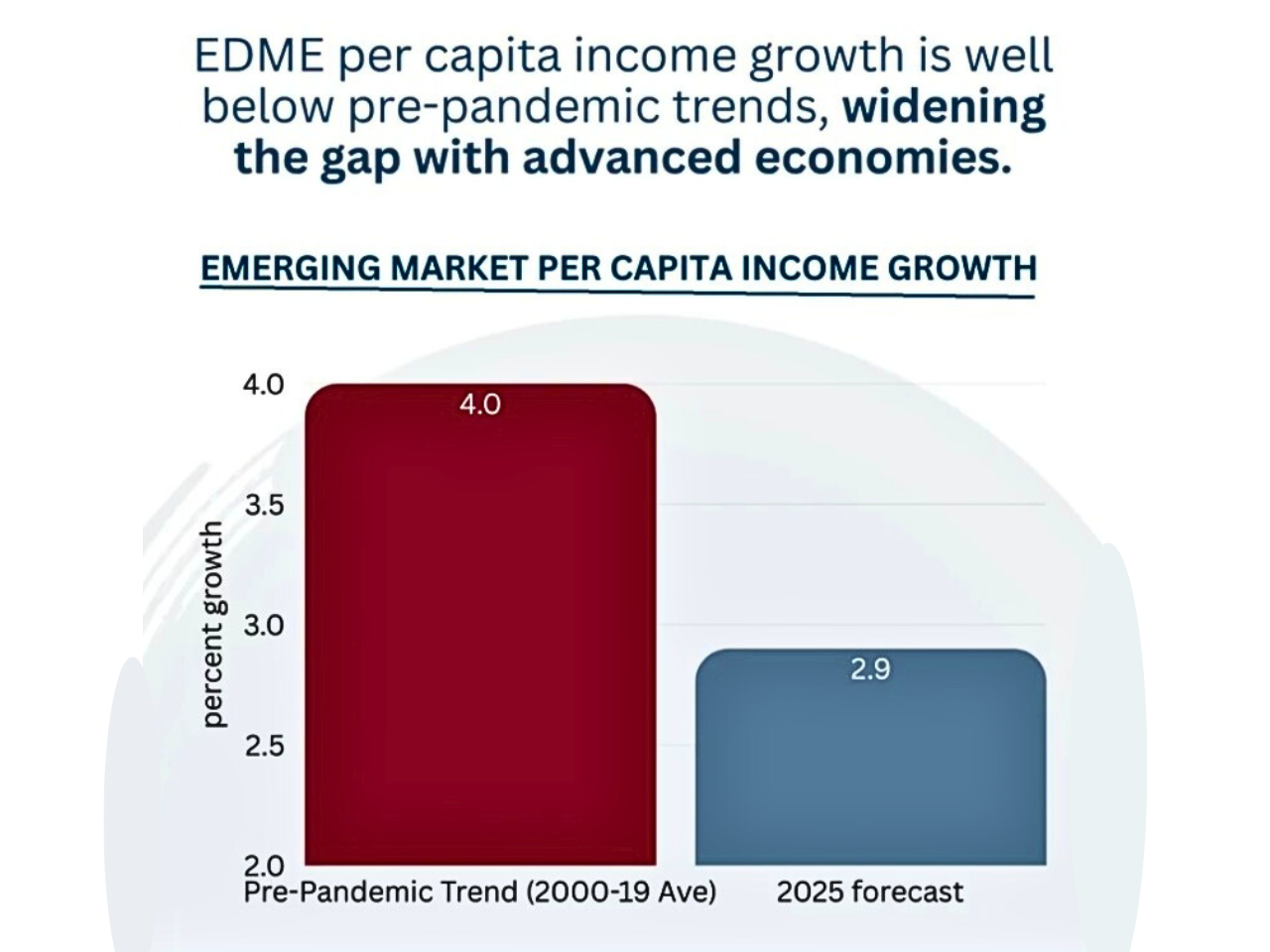

A recent report by the World Bank on Global Growth (June 2025) has a pessimistic picture of the world economy, with signs of weak growth, stagnation in investment, and already increased trade tension in stressful conditions. For developing economies, the outlook is even less sanguine, threatening to carry forward further progress with existing debt burdens, weak financial conditions, and climate shocks. The report estimates that the global GDP growth is only 2.3% in 2025, and it is one of the worst growth rates seen outside the recession in some time. In the decade before the pandemic, average growth was about 3.5% annually by comparison. The recession is widespread, estimated to increase by 1.2% with advanced economies, while emerging markets and developing economies (EMDEs) have reported an estimated 3.8% increase. The report also states that the increase after 2025 will also be under control, only 2.4% in 2026 and 2.6% in 2027.

The risks are decidedly to the downside, with any geopolitical conflict, financial strain, and climate disruptions posing huge risks to an already unstable global situation. One of the longest-running challenges is the stagnation of global investment, which has been overly resilient since 2015 and slowed significantly most recently in developing countries. Investments in emerging markets and developing economies (EMDEs) expanded at an annual rate of 7% from 2000 to 2010; however, the annual rate has declined to less than 4% in the current decade. This weakness is a direct attack on productivity growth and development outcomes. Without stronger investments in infrastructure, clean energy technologies, education, and technology, many economies will increasingly fall behind in their progress of poverty mitigation and income convergence with the developed world. Global inflation appears to have stabilized from the extraordinary rates experienced in 2022–23. However, core inflation (food and energy are excluded from core inflation) remains high in many economies.

Global average inflation is projected to be 2.9% in 2025–2026, with many central banks acting to maintain relatively high interest rates to stabilize food prices and futures prices due to inflation. Although interest rates are necessary to stabilize food and futures prices, a prolonged stance of low investment and high interest will dampen demand further. In addition, low demand can be even more harmful to developing economies that suffer from already relatively high levels of debt and other sources of financial fragility. The Political and Economic Balance Act is likely to dominate economic policy formulation in the near period between inflation price control and continuous increase dynamics. Trade, which had proven to be a critical mechanism for much of the last several decades of global development, is collapsing. Global merchandise trade growth is now forecasted at 1.8% in 2025; this is unimaginably far below pre-pandemic levels. The extension of increased protectionism, the addition of new tariffs, and supply chain fragmentation are creating further barriers. New protectionist measures could create barriers in critical subsectors, including semiconductors, minerals, and a large range of agricultural products. According to the World Bank, a resolution of disputes and reduction of trade barriers could add upward momentum and possibly add 0.2 percentage points to growth over the next two years. Problems with foreign direct investment (FDI) are a second major challenge. Incomes into EMDEs are now less than one-half of their appeal in 2008. FDI has been a long-standing means for many countries of gaining technology transfer, job creation, and productivity growth. With FDI slipping, developing economies are more dependent on debt and domestic savings, bringing them into contact with financial shocks. Investors will need a combination of policy reform, institutional integrity, and a forecast regulatory environment to regain confidence.

Free Membership Register

East Asia and Pacific: Development forecast 4.5% but decreased by slow demand from China. South Asia: forecast growth of 5.8%, making it the fastest-growing region, led by India with 6.3%. Sub-Saharan Africa: forecast growth is 3.7%, not sufficient to address population growth. Europe and Central Asia: forecast growth of 2.4%, limited by the war in Ukraine and energy costs. Latin America and the Caribbean: war-torn and mired in low investment and stagnant at 2.3%. Middle East and North Africa: forecast growth of 2.7%, continued support from oil, but fiscal pressures tempered growth. The World Bank has identified three important policy pillars to gain momentum. It is important for sustainable development to revive target investment in infrastructure, digitization, and climate-flexibility expenses. In developing economies, fiscal space authorities should rebuild revenue, reduce the dependence on subsidy, and support subsidy to support social and development programs. The international community should also be prepared to assist delicate and conflict-affected states. Global Economic Prospects (June 2025) clarifies that the drivers of global development (trade, investment, and financial stability) are severely weak. In the absence of bold action, developing economies are at risk of suffering from dull growth and inverted "lost decades." Nevertheless, there is also a reason for optimism. With infrastructure and investment in people, sound fiscal policy, and renewal by global cooperation, economies can successfully navigate these turbulent times. The options made in the coming year will determine whether the next decade will be characterized by a renewed opportunity for inequality or collective flexibility and development.