Global Economy: Stable Growth, Unequal Recovery

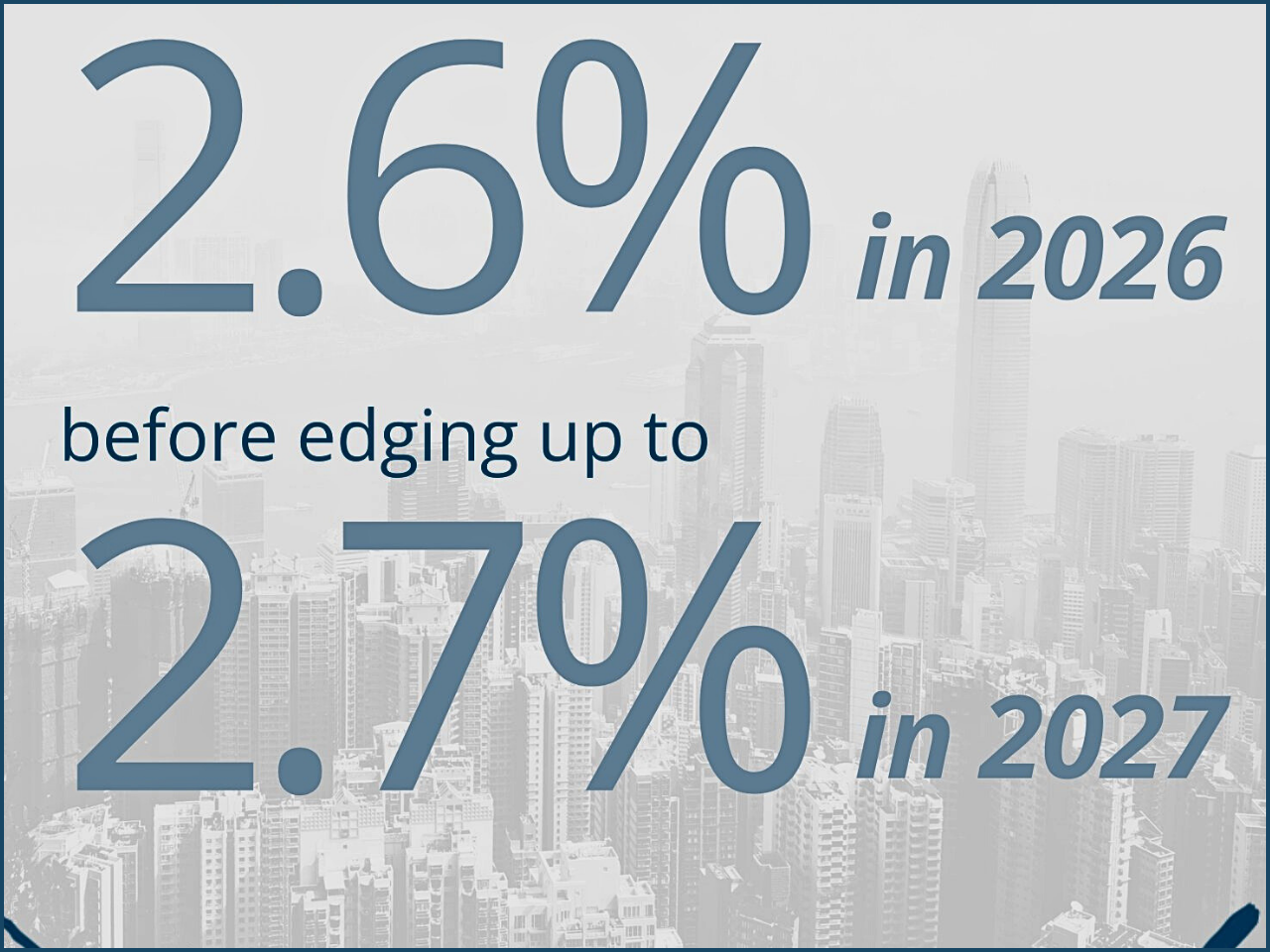

The world economy has shown remarkable stability under the continued geopolitical tensions, stricter financial situations, and uncertainty of policies. The report Global Economic Prospects, January 2026, indicated that the global economic growth is expected to reach a stable level of 2.6 percent in 2026, but it will increase to 2.7 percent in 2027. Although these numbers indicate a gradual upward trend in recovery, they also highlight a dispiriting truth that the benefits of such recovery are not being evenly distributed between regions and income groups.

The report also highlights that the world economy has been able to escape deep economic downturns despite the dislocation in global trade and inconsistent investment climates. The inflationary forces have subsided in most of the developed economies, which means that central banks can now pursue less restrictive policies on monetary policies. This relaxation has given breathing room to households and businesses, which has led to a stable demand condition. Its growth momentum is, however, weak. The long-term perspectives are still burdened by structural issues like low productivity, population changes, and increasing debts. The global economy is growing, as the projections show that 2026 and 2027 will experience growth, although at a lower rate compared to the trends that were experienced before the pandemic. The report notes that this slow recovery trend is specifically sensitive to the re-emergence of trade barriers, financial instability, or intensification of geopolitical tensions. The report has made one of the most vivid discoveries, and that is the unequal world recovery. The developing economies, on average, continue to record lower per capita GDP than they did in 2019, the year before the COVID-19 pandemic. This figure explains the extent to which the economic shocks of recent years have hit the countries of low and middle-income. Although most developed economies are mostly recovering their production levels before the pandemic, most developing countries are still grappling with poor investment opportunities, expensive borrowing conditions, and limited fiscal ability. Low availability of cheap finance has inhibited their capacity to spur growth or invest in some of the key areas like infrastructure, education, and health.

Economies that are dependent on commodities have been particularly susceptible. Unpredictable prices of energy, food, and raw materials in the world have caused economic instability, thus complicating recovery. In a number of low-income nations, increasing debt servicing costs are also taking away the little resources needed to focus on developmental activities. Global trade has been one of the major drivers of economic performance, but it is experiencing increasing challenges. Continuous trade conflicts and protectionist policies have broken the supply chains and weakened the cross-border investment flows. The report observes that such aspects still cause unpredictability, which discourages long-term business planning and raising capital. The international economic environment is further becoming difficult due to technological fragmentation and strategic rivalry between key economies. Technology transfers and export controls may be redefining the networks of global production, usually to the disadvantage of the developing nations that depend greatly on the incorporation into the worldwide value chains. However, the trade activity will improve gradually with a reduction in inflation and a restoration of normal demands. The slight increase in the world growth that is expected next year, 2027, is based on the assumption that trade relations will become stable and there will be better coordination of policies between the key economies.

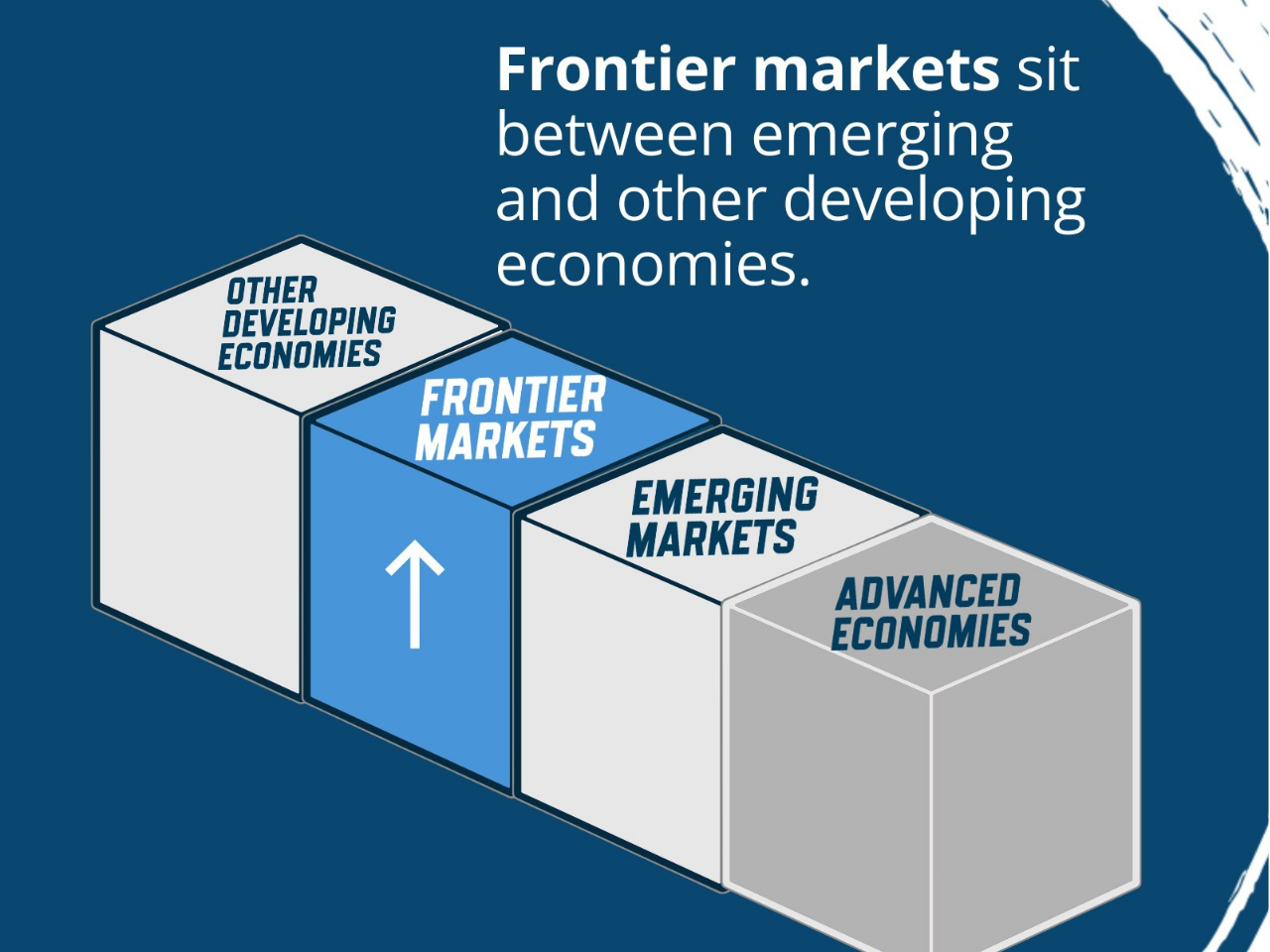

The patterns of economic recovery vary significantly in the regions. Most developed markets will continue to have moderate but steady growth, which will be backed by a robust labor market and consumer purchases. Conversely, some of the emerging markets are experiencing chronic headwinds in the form of currency depreciation, outflows of capital, and fiscal constraints. It is estimated that Sub-Saharan Africa and some parts of Latin America would recover more slowly than Asia. Diversified countries whose export abilities and domestic demand are high, especially in South and Southeast Asia, will perform better compared to those that rely on a limited number of commodities. As highlighted in the report, nations that invest in digital transformation, renewable energy, and human capital development are in a position to attain structural growth. On the other hand, politically unstable countries, experiencing conflict, or other calamities related to climate, stand on high chances of being left behind even more.

To manage this imbalanced character of the recovery, the Global Economic Prospects report recommends national and international action to respond to the recovery. Among other critical recommendations are: Increasing investment in emerging economies, it is necessary to increase access to cheap money to develop infrastructure and expand the private sector. Increasing the sustainability of debts in most of the low-income nations, debt restructuring and relief are necessary to restore fiscal space. Restoring health to the international trading partnership means that the barriers to trade and the encouragement of international agreements may be used to regain confidence and encourage investment. Increasing productivity and innovation implies the necessity of investing in education, technology, and green transition strategies to increase competitiveness in the long term. Ability to withstand future shocks. It is necessary to establish more social safety nets and disaster preparedness mechanisms to help vulnerable populations. The divide between advanced and developing economies can possibly increase further, thus becoming a threat to the stability of the global economy without decisive action. The projections of 2026 and 2027 are a cautious optimism. A stable growth trajectory implies that the world economy is slowly adapting to the reality of the post-pandemic.

Nevertheless, in the majority of cases, most of the countries are not reaping the full benefits of this development because of the persistence of deep structural inequalities. The ability to reduce uncertainty, promote investment, and support the most vulnerable economies will lead to sustainable and inclusive growth. The world still needs international cooperation to solve such prevalent problems as climate change, the digital revolution, and the debt crisis. In a word, the global economy is at a crossroads. Despite the positive picture of aggregate growth rates, the insider stories of the situation are different. Making sure that the economic benefits are distributed across countries and communities will become the challenge of the next decade.

Monthly Edition