Electricity Demand Surges: Global Consumption Set to Skyrocket in the 'Age of Electricity'

Global electricity consumption is entering a period of sustained and accelerated expansion, marking what many describe as the “Age of Electricity.” Between 2026 and 2030, worldwide electricity demand is projected to grow at an average annual rate of 3.6%, significantly faster than in the previous decade. This surge is driven by rising industrial production, rapid adoption of electric vehicles, expanding use of air conditioning, and the proliferation of data centers supporting digitalization and artificial intelligence. After increasing by 4.4% in 2024 and 3% in 2025, annual demand growth over the next five years is expected to be roughly 50% higher than the average recorded over the past decade.

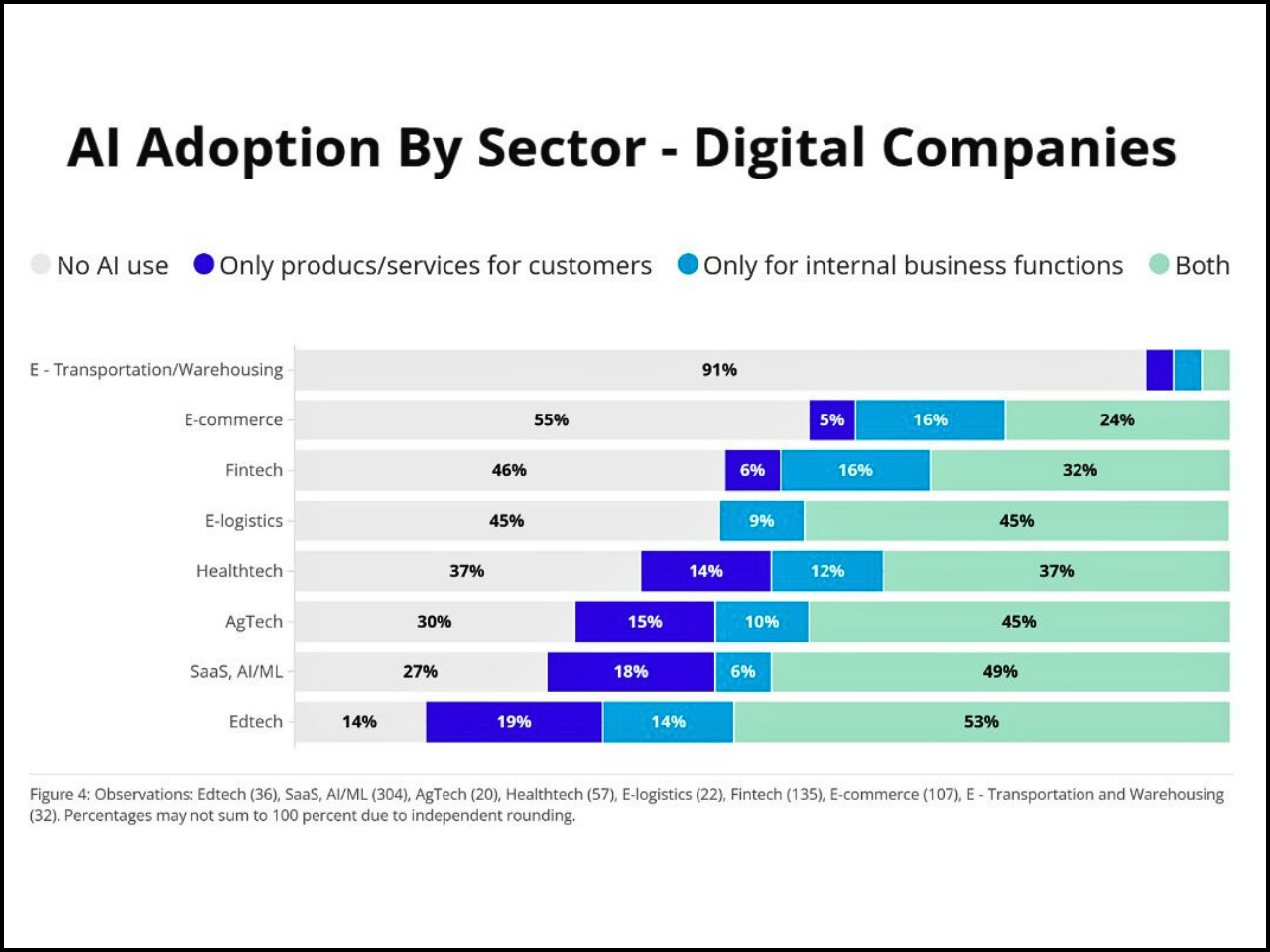

Electricity consumption is changing permanently and exceeding global economic growth (excluding economic crises) in 2024 for the first time in decades. Weather-constrained 2025 electricity demand growth, but electricity demand will increase at rapidly accelerating rates, projecting it will be 2.5x total energy demand by 2030, driven by sector-wide (i.e., industry, buildings, and transport) rapid electrification and the increasing importance of electricity in a growing number of economies. Demand growth will continue to be primarily driven in developing and emerging economies during this period—approximately 80% of the new global electricity consumption within the next decade will come from these economies. The most notable example will be China, as it will contribute over 50% of the new increases in annual electricity consumption, growing at a rate of 4.9% annually until 2030. This will put the incremental electricity demand from China over the next five years at approximately the total annual electricity demand for the entire EU. India and Southeast Asia are likely to continue to expand their share of total new demand due to strong economic performance, as well as the increased need for air conditioning, which will contribute to both increases in total consumption and increases in peak loads. Electricity use is growing again after more than 15 years of stagnant growth in advanced economies. By 2025, these economies will have accounted for almost 20% of global electricity demand growth and are expected to retain this share until 2030. The growth is being driven by the emergence of new electricity-demanding activities such as data centers, AI-enabled applications, advanced manufacturing, and electric mobility. In the US, electricity demand increased by 2.1% in 2025 and is expected to grow close to 2% per year until 2030, with around half of the growth being due to the expansion of data centers. The EU is also likely to have higher growth than before, approximately 2% per year, though total electricity consumption will not likely recover to the 2021 level until 2028. Similarly, other advanced countries are also expected to experience higher growth, including Australia, Canada, Japan, and South Korea. The global electricity generation mix will be restructured on the supply side through an increase in renewables and nuclear capacity. It is projected that by 2030, approximately half (50%) of worldwide electric power production will have been generated through the combination of renewables and nuclear sources.

From 2022 to 2030, renewable energy output (the vast majority of which will come from solar photovoltaic, or PV, systems) is likely to grow at a rate of about 1000 terawatt-hours (TWh) annually during that time horizon, with approximately 600 TWh of that growth coming from solar PV systems alone. Overall, renewable generation is expected to increase at a compound annual growth rate of approximately 8% over this same time period. Hydropower and wind energy production in some areas of the world were temporarily constrained by weather, but their long-term growth projections were maintained. According to reports, nuclear power production increased significantly throughout 2025 and is anticipated to continue increasing through 2030 due largely to developing nations expanding their nuclear power capabilities (China being the largest country). Mature nations will also extend the life of existing reactors and add new reactor capacity. While coal production will decrease slightly, it will still be the greatest individual source of electricity in 2030, with the regional variation of electricity output balancing the total amount of electricity generated globally by all methods. Current electricity consumption trends indicate that nearly all future electricity will come from renewable energy sources, natural gas-fired power, and nuclear energy, with gradual decreases in coal-fired power generation. Gas-fired generation will continue to grow at approximately 2.6% each year, with the majority of that growth occurring in the US through the conversion of existing coal plants to gas or switching from coal to natural gas. The electricity system is experiencing significant changes with new patterns of generation and consumption. The share of solar photovoltaic (PV) and wind generation globally is expected to increase from 17% to 27% by 2030, while over 2,500 gigawatts (GW) of new electricity generation, energy storage, and large-scale electricity users are stuck in grid connection queues to be ready to meet future electricity demand. The annual investment in electricity grids will need to increase by approximately 50% from the current level of $400 billion to be at the required level to meet anticipated demand for electricity by 2030.

Increased utilization of existing capacity of the electricity grid, regulatory reforms, and the deployment of grid-enhancing technology can release up to 1,600 GW of advanced projects that are yet to connect to the electricity grid today. Utility-scale battery energy storage is growing at an accelerated rate and is emerging as a key provider of short-term flexibility. While traditional electricity generation sources (thermal power plants) currently provide the majority of flexibility services, utility-scale batteries will become increasingly important for balancing large shares of variable renewable generation. Utility-scale battery prices have reduced rapidly over the past several years in response to the increased demand and supportive government policy in many areas where utility-scale batteries are deployed and where there are strong solar or wind resources being developed. In 2030, global carbon emissions from the electric power sector are likely to remain stable while renewable energy sources and nuclear power continue to decrease the carbon intensity of electricity generation, even though most of the world’s energy-related CO₂ emissions come from electric generation. Household electricity prices have increased more than income over the last few years, primarily due to the costs of supporting the power grid system, taxes that support various government programs, and differences in regional prices influencing how businesses operate. Increased demand for electricity has also created security risks through increased vulnerability to electric outages resulting from aging electrical generation and transmission infrastructure, severe weather, and cyberattacks, all of which require greater grid reliability, greater resilience in fuel supply chains, and greater balance between energy policies to achieve reliable, low-carbon, affordable electricity.

Monthly Edition